The legal protection of the accrued contributions in the Greek Public Pension Fund for the Self-Employed in view of the latest reductions

Abstract

receiving low and high old-age pension benefits. The second part analyses the legal protection of the high-earnings pensioners precipitated by the Greek financial crisis. It is concluded that while there is no existing legal protection, there are some moral and legal arguments in support of their protection to

ensure that their legal status is not undermined due to restricted financial resources.

Article Details

- How to Cite

-

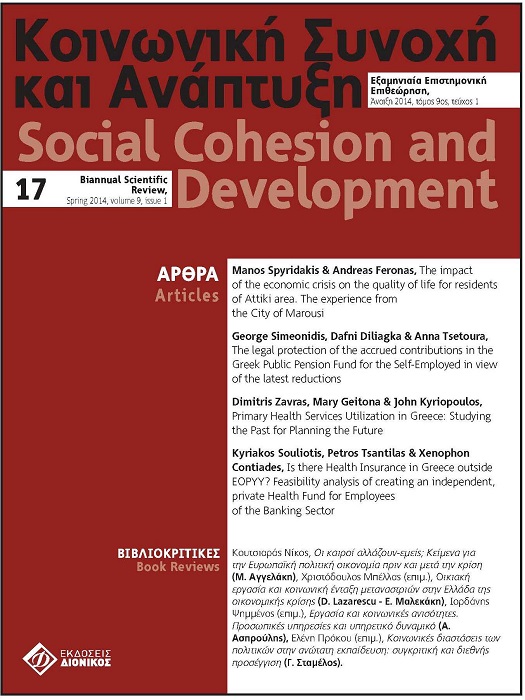

Simeonidis, G., Diliagka, D., & Tsetoura, A. (2016). The legal protection of the accrued contributions in the Greek Public Pension Fund for the Self-Employed in view of the latest reductions. Social Cohesion and Development, 9(1), 29–48. https://doi.org/10.12681/scad.8924

- Issue

- Vol. 9 No. 1 (2014)

- Section

- Articles

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.

Authors who publish with this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution Non-Commercial License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g. post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (preferably in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See The Effect of Open Access).